THE MIDDLE EAST’S LARGEST EVER HEALTH & FITNESS SURVEY

- Introduction

- Key Findings

- How We Collected the Data

- Health Perceptions: How Do We Feel About Ourselves?

- Experience & Exercise Habits

- Barriers & Motivations

- Diet & Nutrition

- Money Matters: Financial Considerations & Spending

- Social Factors

- Trends, Tech & The Future

- Market Research: A Global Comparison

- Wrapping It Up: Conclusion

- References

Introduction

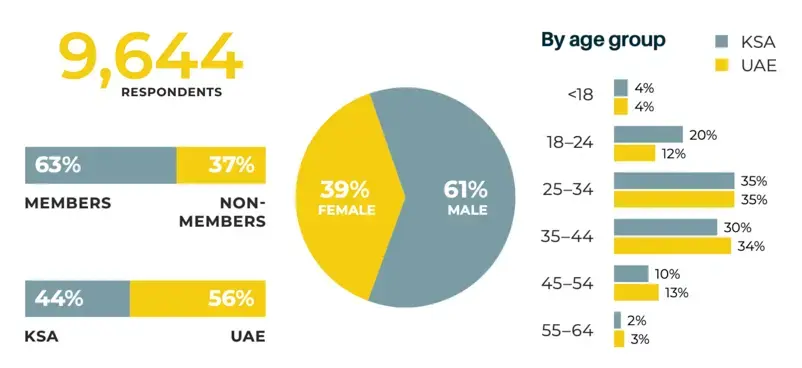

Welcome to our inaugural Health & Fitness Report, the largest of its kind in the region, with responses from 9,644 individuals across the Kingdom of Saudi Arabia and the United Arab Emirates covering important topics such as perceptions, behaviors, motivations, socioeconomic factors, and much more.

At GymNation, our goal is simple but ambitious: to become the “Region’s Movement Partner” and democratize health and fitness for all. We conducted this research to live up to our commitment to empowering our communities to strive for healthier, more fulfilling lives. I am particularly proud that the report highlights the link between the nation’s progress in nurturing healthier generations and the role we, as an industry, can play in helping people lead fitter lives. However, our findings highlight specific barriers—including limited supply, affordability concerns, time constraints, and “gymtimidation”—all of which are real issues and point to the continued need for collective action.

We hope our research presents a compelling case that these barriers can indeed become opportunities. Currently, Dubai and Riyadh rank among the world’s most expensive cities for gym memberships, at third and fifth place, respectively—making them 150% more expensive than Stockholm, 25% more than London, and 15% more than New York. When we surveyed the public, they echoed these same concerns, with cost and the availability of locations cited as the primary obstacles to exercising.

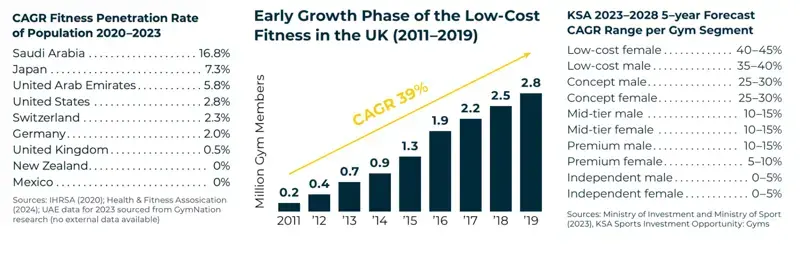

However, we see growth on the horizon and similarities with the early stages of the explosive growth witnessed in the UK when low-cost gyms entered the market in 2011, expanding the sector’s membership base from 200,000 to 2.8 million over an eight-year span. We believe we are in that same pre-take-off era, and it’s not just us saying it, as you’ll see by third-party research estimating that low-cost gym memberships are projected to grow by 30–45% CAGR over the next five years in this region.

We hope this research inspires action in our sector and ultimately leads us toward a more active, inclusive, and health-focused future as this region continues to evolve.

Key Findings

STRONG DESIRE TO BE HEALTHY

- 92% of respondents in KSA and the UAE aspire to improve their health, far higher than in the UK (76%) and the USA (75%).

- 64% report their health has improved over the past year, with an additional 26% having maintained it.

- The overall market trajectory supports this focus: Saudi Arabia is witnessing an increase in penetration of gym users at 16.8% CAGR from 2020 to 2023—the fastest globally— while the UAE ranks third at 5.8%.

A BOOM IN FIRST-TIME GYM-GOERS

- 56% in Saudi Arabia and 58% in the UAE did not have a gym membership in the previous 12 months, highlighting substantial untapped potential.

- Despite this, 82% describe themselves as at least somewhat active, with 79% working out twice a week or more.

- Government data (Ministry of Investment and Ministry of Sport, 2023) anticipates low-cost gym memberships in KSA to surge with a CAGR of 35–40% for men and 40–45% for women over the next five years, validating the trend of large-scale market entry by new users.

GROWING THE MARKET, NOT JUST TAKING SHARE

- Over half of new GymNation members had no prior gym membership 12 months before joining, which emphasises the role of affordable operators in expanding the fitness landscape rather than simply attracting customers from existing providers.

- The Middle East is currently experiencing an early growth phase in the low-cost, high-value gym sector, akin to what the UK saw in 2011. During that period, low-cost gym memberships in the UK grew at a CAGR of 39% over eight years, while traditional private gyms saw no net growth. Memberships in low-cost gyms increased from 200,000 to 2.8 million, leading to an increase in the UK’s gym penetration rate from 11.9% to 15.6%.

“GYMTIMIDATION”

- Nearly half of all participants experience some form of gym intimidation—particularly among women (50% vs. 42% for men).

- Common reasons include unfamiliarity with equipment, lack of knowledge of exercises and feeling self-conscious about exercising around others.

- These figures point to a need for beginner- friendly environments, support, and better education to help newcomers get started comfortably.

AFFORDABILITY AS A KEY DRIVER

- Cost is the top hurdle for non-members: 51% in Saudi Arabia and 53% in the UAE believe gym memberships are too expensive.

- According to Deutsche Bank Research (2019), Dubai is the third most expensive city in the world for gym memberships, while Riyadh is fifth. Compared to Stockholm, which is recognised for having the highest gym membership penetration rate globally, Dubai’s gym fees are 150% higher. Additionally, they are 25% more than London and 15% more than New York City.

- Existing members cite price as the second main reason for leaving, reinforcing the importance of affordable membership models.

- Research on the low-cost gym boom in the UK from 2011 to 2019, when low-cost gyms came to market, revealed a remarkable 39% CAGR in low-cost gym memberships. The number of low-cost gym members surged from 200,000 to 2.8 million over the eight- year period. This growth increased the UK’s penetration rate from 11.9% to 15.6%, while the traditional gym market experienced no net growth during the same time (The Gym Group PLC, 2016, 2020). GROWING SPEND ON FITNESS

GROWING SPEND ON FITNESS

- 43% in KSA and 51% in UAE of participants have increased their fitness spend in the last year, versus just 24% in the UK.

- More than half of respondents (62% KSA, 55% UAE) plan to increase their spending in 2025, reflecting a robust market poised for continued expansion.

- This willingness to invest is further boosted by government-led initiatives (e.g., Vision 2030 (2024) in Saudi Arabia and the Dubai Fitness Challenge (DFC, 2024) in the UAE), which promote active lifestyles and support industry growth.

STRONG SOCIAL AND MENTAL HEALTH MOTIVATIONS

- Nearly half see the gym as part of their social life, with one in five forging meaningful friendships there.

- 92% also place high importance on mental well-being, viewing exercise as crucial for stress reduction and overall health improvement.

- These findings align with the region’s growing emphasis on wellness, including the uptake of wearable devices and healthy eating habits. Across Saudi Arabia and the UAE, the collective determination to embrace healthier lifestyles—bolstered by rapid market growth, favourable government policies, and rising consumer awareness—positions the region for transformative development. While issues like gym intimidation and affordability remain challenging, the willingness to invest in physical and mental well-being suggests that the Middle Eastern fitness industry has a bright and promising future.

How We Collected the Data

Methodology

Our aim was to reach as many people as possible with our survey, ensuring we gathered a wide range of perspectives and the best possible representation of our populations.

We recognize that because we are a high-value, low-cost operator, our sample may not fully reflect the overall population.

To mitigate this, we aimed for a substantial response volume (n=9,644), comprising both members (63%) and non-members (37%) across two nations.

Among participants, 44% were from Saudi Arabia and 56% were from the United Arab Emirates, with a gender distribution of 39% female and 61% male.

- Questionnaire Design: The survey primarily featured closed-ended questions (multiple choice, yes/no, Likert scales) to enable quantitative analysis.

- Language: The questionnaire was provided in both English and Arabic, accommodating participants from diverse backgrounds.

- Response Validation: Participants were permitted only one submission, with duplicate entries filtered out by checking IP addresses.

While we aimed to reach a broad demographic, the sample may still be somewhat more health-conscious than the wider public, given the platforms used for recruitment.

Nevertheless, we believe the survey offers a robust snapshot of current attitudes, behaviors, and barriers relating to health and fitness in Saudi Arabia and the United Arab Emirates.

Health Perceptions: How Do We Feel About Ourselves?

How Do We Feel About Ourselves?

A closer look at how people rate their health and what they hope to achieve.

ARE WE LOOKING AFTER OURSELVES AS MUCH AS WE SHOULD AND WHAT

ARE OUR ASPIRATIONS?

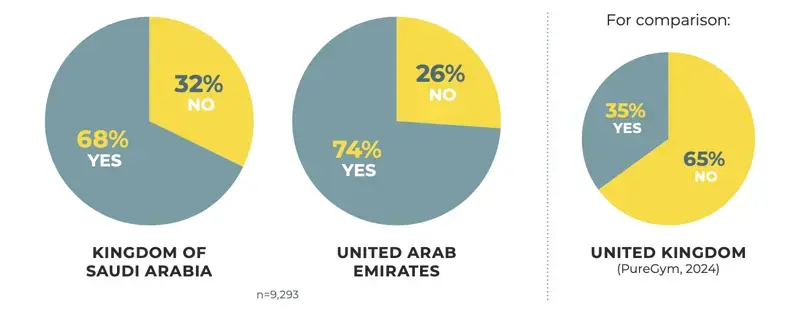

When asked if they felt they were taking care of their health as much as they should, 32% of respondents in Saudi Arabia and 26% in the United Arab Emirates felt they weren’t doing enough for their health.

Do you feel that you look after your health as much as you should?

However, a striking 92% indicated that becoming healthier is a major aspiration. In contrast, this aspiration was shared by only 76% of people in the UK (PureGym, 2024) and 75% in the USA (Life Time, 2024), representing a difference of 16 and 17 percentage points respectively. Furthermore, 65% of people in the UK felt they weren’t looking after their health as much as they should, double the rate from our region, suggesting a strong push towards a healthier lifestyle likely bolstered by government efforts such as the Dubai Fitness Challenge (DFC, 2024) and Saudi Vision 2030 (Vision 2030, 2024).

SO, ARE WE LIVING UP TO OUR ASPIRATIONS IN THIS REGION?

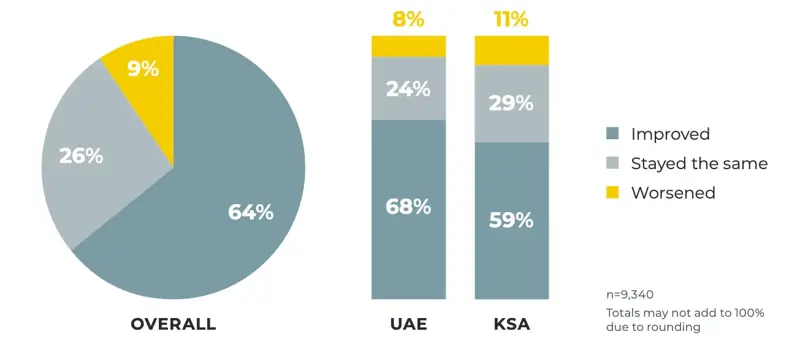

The good news is that the region appears to be moving in the right direction. 64% of people stated their health has improved year on year, while 26% say they have at least maintained their health. These findings reinforce the narrative that the majority of people are progressing towards improvement of their health and fitness.

Do you feel your overall health has improved, stayed the same, or worsened?

(Compared to this time last year)

OVER HALF OF NEW GYMNATION MEMBERS HAD NO PRIOR GYM MEMBERSHIP IN THE 12 MONTHS BEFORE JOINING. AFFORDABLE OPERATORS MAKE THE GROWTH OF THE FITNESS MARKET POSSIBLE.

Experience & Exercise Habits

How many people have never been to the gym before

(or are skipping it), and how often are they working out?

GYM NEWBIES — HOW MANY ARE THERE?

Well, when asked about their past gym experiences, 56% of new gym members in Saudi Arabia and 58% in the United Arab Emirates said said they didn’t have a gym membership in the 12 months before joining. That means a big chunk of members are new to the gym scene. This highlights the market potential for expanding health and fitness opportunities in these countries, as awareness and the desire to become healthier continues to grow.

NOW, WHAT ABOUT HOW ACTIVE PEOPLE ARE IN GENERAL?

Overall, 82% of respondents report being at least somewhat active, with 30% describing themselves as highly active, and only 3% indicating they are not active at all. This aligns with the previously stated desire to improve health and well-being. And when you look at how often people actually work out, 79% are doing at least two sessions a week on the regular.

Barriers & Motivations

What prevents non-members from joining, and what motivates

members to continue?

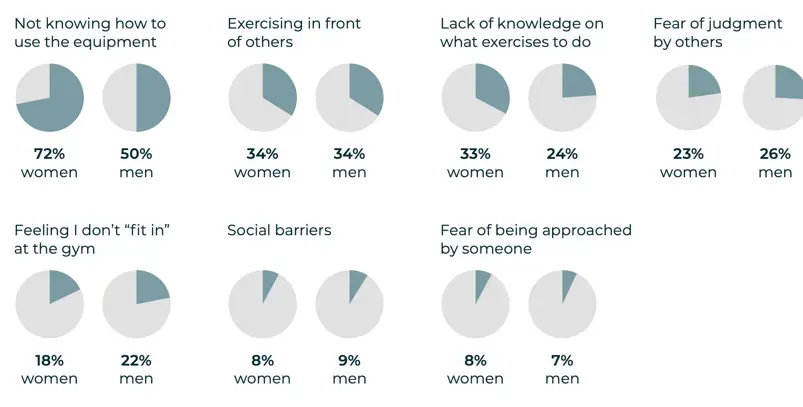

“GYMTIMIDATION”: IS IT A REAL ISSUE?

Absolutely. In fact, nearly half of all respondents reported experiencing some form of intimidation at the gym. This feeling is more common among women, with 50% of female respondents reporting it compared to 42% of male respondents. This is understandable given our research, which indicates a large proportion of gym newbies. In the UK, which has a more experienced gym base, only 25% of females and 16% of males stated that they felt intimidated at the gym (PureGym, 2023). This disparity again suggests that our region has a larger population of less experienced gym-goers.

WHAT’S CAUSING THIS FEELING?

Looking closer at the reasons for this intimidation, a clear pattern emerges. The most significant factor, especially for women, is a lack of familiarity with gym equipment, with 72% of females reporting this concern, compared to 50% of males, In contrast, only 29% reported similar concerns in the UK (Terry, 2022). Second on the list is unease about exercising in front of others, with 33% of females and 34% of males reporting this. This is closely followed by a lack of knowledge on what exercises to do, with 33% of females and 24% of males reporting this. To tackle these challenges, we offer a free introductory PT session for all new members, along with women-only sections in most facilities. Our member engagement strategy also includes weekly and monthly gym-floor challenges and events to foster community within traditionally male-dominated areas. For us, It’s all about providing support and building community to navigate these barriers.

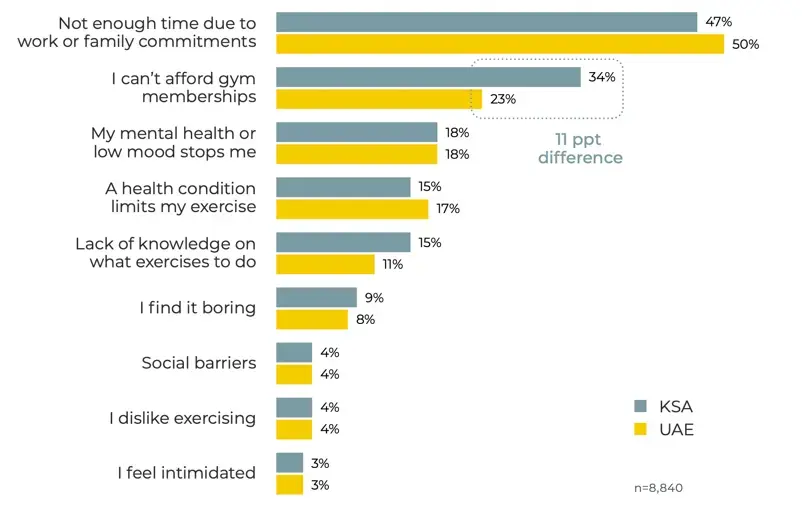

Barriers to using the gym

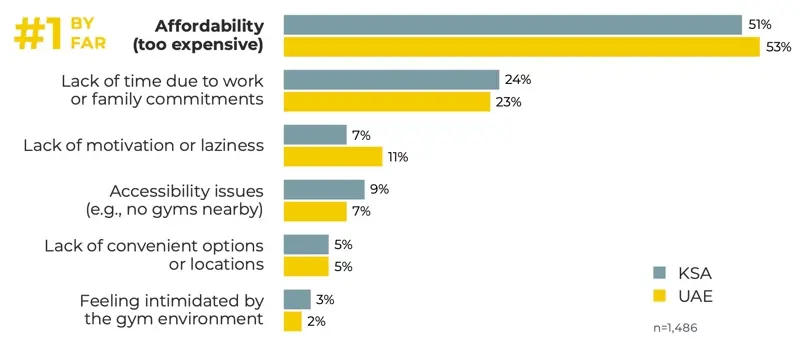

FOR NON-GYM HOLDERS, WHAT’S BEEN HOLDING THEM BACK?

For those who haven’t yet joined a gym, what are the main barriers? Finding out why people in the region have not yet taken the step to purchasing a gym membership allows us to address these concerns and help become the region’s movement partner. According to our research, the top reason for not having a gym membership in both Saudi Arabia and the UAE is affordability, with 51% and 53% of respondents, respectively, stating that gym memberships are too expensive. A lack of time due to work or family commitments is also a major factor, with 24% of respondents in Saudi Arabia and 23% in the UAE reporting this as a barrier.

Why haven’t you joined a gym?

AND FOR GYM MEMBERSHIP HOLDERS, WHAT’S THE MAIN REASON

THEY ARE LEAVING?

Our data shows that time commitments and price are the primary drivers of membership attrition. 50% of members cite time as the main reason for stopping, with price as the second most significant factor, notably higher in Saudi Arabia (34%) compared to the United Arab Emirates (23%). Our market research identified this trend as the key driver behind our expansion into Saudi Arabia, allowing us to offer high-value, low-cost memberships to those who may be priced out by other gyms.

Why have you stopped going to the gym?

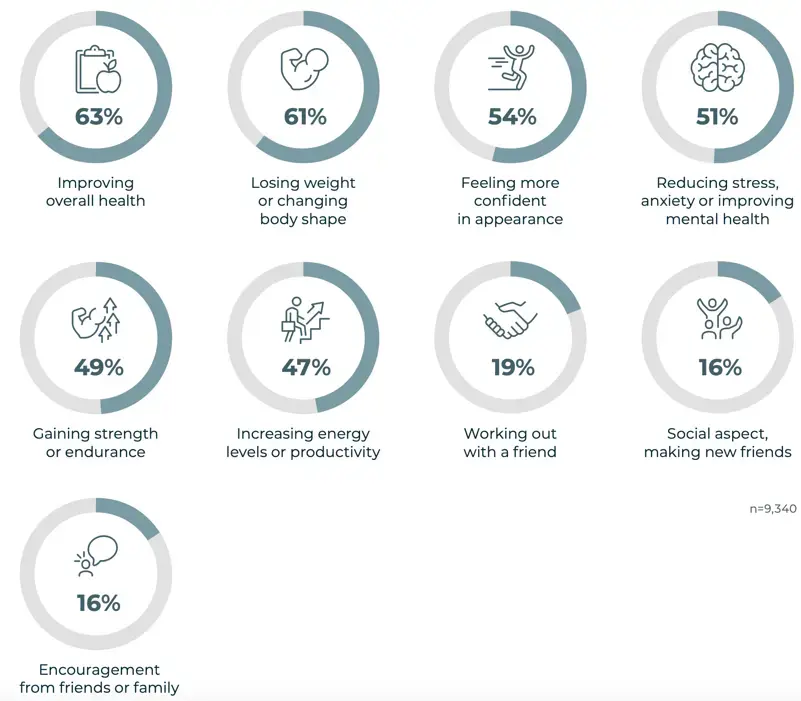

WE’VE COVERED THE BARRIERS, BUT WHAT ABOUT THE MOTIVATIONS?

Improving one’s health is the number one motivator, closely followed by body composition goals, at 63% and 61% respectively. This ties back to our earlier research where 92% of respondents aspired to improve their health, and is a great sign of the region’s work in supporting the nations’ health and fitness. Coming in third is feeling more confident with their appearance at 54%, and fourth is reducing stress and improving mental health at 51%, followed by 49% wishing to get stronger or improve their endurance. Interestingly, working out with friends, or the social aspects, don’t seem to be very strong motivators, as only 19% of people say working out with a friend motivates them to exercise.

What motivates you to exercise?

WHAT ABOUT MENTAL HEALTH AWARENESS AND ASPIRATIONS?

The region is clearly taking this matter seriously, with a staggering 92% of respondents stating they wish to improve or further support the development of their mental health.

Diet & Nutrition

A peek into eating habits and attitudes about diet

ARE WE EATING WELL?

When asked to describe their diet, 69% of respondents felt it was healthy, 13 percentage points higher than the 53% reported in the UK (PureGym, 2024). This is great news, with two-thirds of people feeling they eat well. However, 14% are unsure if their diet is healthy, highlighting that there is still a need for more dietary knowledge and support. It’s positive to see government initiatives addressing this, such as the National Nutrition Strategy 2030 (UAE, 2023). This is one of the key drivers in why we decided to support our members with Yalla Chef; we have partnered with a leading meal planning service in UAE to offer healthy, macro-based meals to help people stay on track.

Are you eating healthy?

WE ALL KNOW THE BENEFITS OF TRACKING FOOD INTAKE, SO HOW MANY

PEOPLE DO IT?

While 53% of people state they track their diet at least sometimes, and 14% track it consistently, a significant portion do not actively monitor their food intake. 23% rarely track, and 24% never track calories or food. This highlights that while there is an awareness of monitoring one’s diet, there is still a large percentage who do not, potentially missing out on the benefits of tracking such as increased awareness of eating habits and portion control.

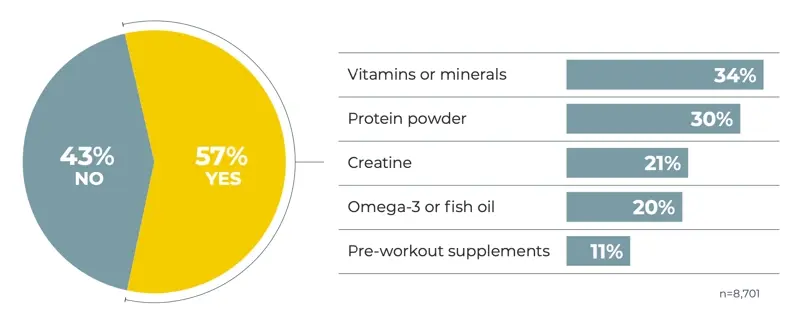

IT’S TIME TO TALK ABOUT GYM SUPPLEMENTS.

There is an age-old question whispered in gyms around the world: “Are you taking any supplements?” So, we decided to ask the public en masse: Do you currently use any dietary supplements for health or fitness?

A whopping 57% of respondents said they are using some form of dietary supplement. Multivitamins took the top spot, with 34% of people using them. Coming in second were protein shakes, with 30% of users chasing their gains by consuming protein powders. Interestingly, 20% reported using creatine and/or omega-3 supplements, which could be indicative of a greater focus on performance or optimising health through nutrition.

Do you currently use any dietary supplements for health or fitness?

AFFORDABILITY IS THE BIGGEST REASON PEOPLE DON’T JOIN GYMS, WITH OVER 50% OF PEOPLE STATING THIS WAS THE MAIN REASON THEY HAVEN’T JOINED A GYM YET.

Money Matters: Financial Considerations & Spending

How cost affects fitness choices and where we’re putting our money

LET’S TALK MONEY!

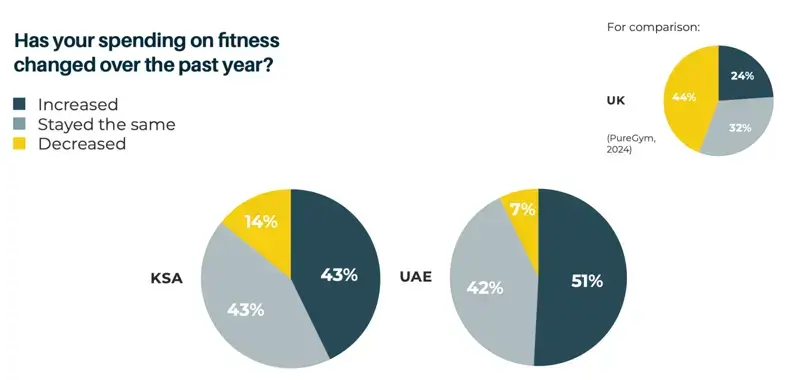

Money matters, and we wanted to get a feel for the population’s spending habits, particularly their rationale for spending on fitness and whether it might be changing. So, the big question: “Has your spending on fitness (gym memberships, home equipment, classes) changed over the past year?”

Remarkably, only 14% of respondents in Saudi Arabia and 7% in the United Arab Emirates reported a decrease in their fitness spending. This is a phenomenal observation, showcasing such a small percentage across both nations. Meanwhile, 43% in Saudi Arabia and 51% in the UAE stated that their spending on fitness has increased over the past year.

This highlights a significant shift, with consumers placing greater emphasis on fitness, reflecting both increased engagement with the market and the overall expansion of the fitness industry as a whole in these regions.

A comparison with the population in the UK reveals a stark difference: only 24% of people in the UK reported increasing their fitness spending over the last year, while 44% stated they had decreased it (PureGym, 2024). This shows nearly double the percentage of people in our region have increased their spending on fitness, and just a third as many reported a decrease, compared to the UK.

SO, WHY THE INCREASE IN SPENDING?

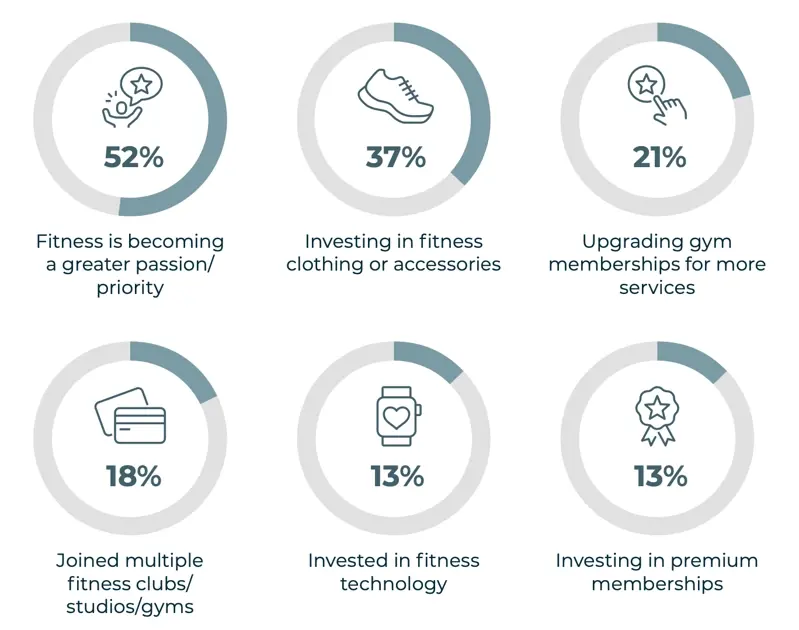

We wanted to uncover the drivers behind this trend. For those who reported an increase in their spending over the last year, where is this money going?

Why did you increase fitness spending?

The main reason is that fitness and health have become a greater passion and priority, with 52% of people stating this as a key motivator for their increased spending, which could suggest a greater propensity for purchasing gym memberships. Following this:

- Gym attire and clothing came in second, cited by 37%.

- Upgrading memberships accounted for 21%.

- Having multiple gym or studio memberships was mentioned by 18% in KSA and 13% in UAE.

- Finally, tech and premium memberships rounded out the list at 13%.

It’s clear that health and fitness are taking centre stage in people’s priorities. But will this trend continue? We wanted to find out the sentiment behind this question, so we asked:

ARE YOU PLANNING TO INCREASE YOUR SPENDING ON HEALTH AND FITNESS IN 2025?

Insights from our earlier research indicate a strong drive within these nations to continue improving health and fitness. This commitment has also translated into a willingness to keep investing in these efforts. Two-thirds of people in Saudi Arabia (62%) stated they plan to increase their spending in 2025, while 55% of people in the United Arab Emirates expressed the same intention. A third of respondents stated they are unsure, and only 6% and 12% in Saudi Arabia and the United Arab Emirates, respectively, indicated that their spending will not increase. GymNation’s goal is to offer the most accessible, high-quality, and affordable memberships to meet the nation’s fitness needs. We only offer pay-monthly options instead of the region’s standard annual upfront membership. We prioritise affordability and avoid imposing high upfront costs. This way, we ensure that investing in fitness in the coming year doesn’t have to break the bank.

Are you planning to increase your spending on health and fitness in 2025?

Social Factors

Friends, family, and community: how they shape our fitness journeys

Staying active isn’t just about the physical benefits—it can also be a significant social outlet. With gyms becoming focal points for many, we looked into the social side of fitness and how it shapes our journeys.

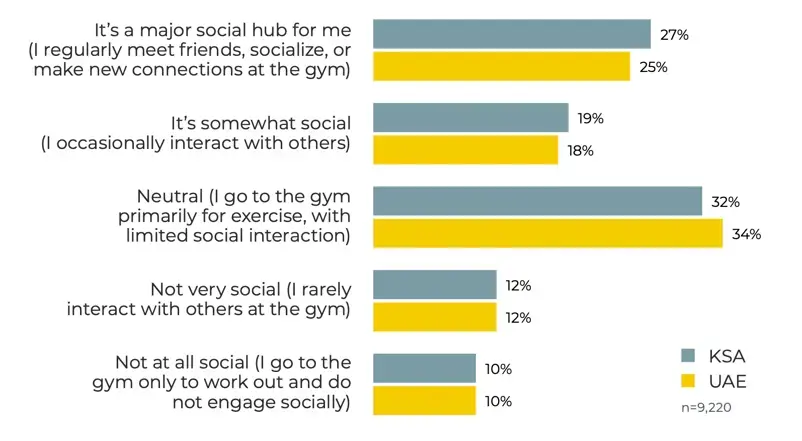

SO, HOW SOCIAL IS THE GYM EXPERIENCE FOR PEOPLE IN THE REGION?

According to our data, 46% of respondents in Saudi Arabia and 43% in the United Arab Emirates consider the gym to be a part of their social lives—nearly half of all surveyed.

Roughly a quarter of respondents in Saudi Arabia (27%) and the UAE (25%) see the gym as a “major social hub.” These individuals report regularly meeting friends, socialising, or forming new connections during their workouts. Meanwhile, about one in five in both countries describe their gym time as “somewhat social,” meaning they occasionally interact with others.

To what extent has going to the gym become a social part of your life?

On the other hand, there’s a notable segment of gym-goers who view fitness as a solitary activity. Approximately 10% of respondents in both Saudi Arabia and the UAE say the gym is “not at all social” for them, while around 12% “rarely interact” with others during their sessions.

However, roughly a third sit somewhere in the middle: 32% in Saudi Arabia and 34% in the UAE describe their gym experience as “neutral,” with these individuals mainly concentrating on their workouts and engaging in limited social interaction.

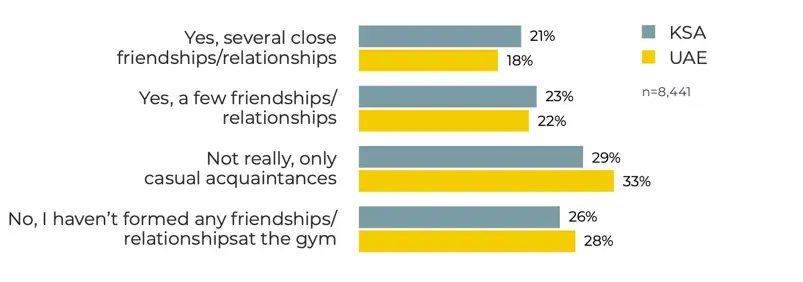

WHAT ABOUT FRIENDSHIPS AND RELATIONSHIPS FORMED AT THE GYM?

It’s one thing to have small talk at the vending machines, but do these interactions lead to genuine relationships? In Saudi Arabia, 21% of people say they’ve formed “several close friendships or relationships” through the gym, with a further 23% stating they’ve at least made “a few” friends. This shows that nearly half (44%) of gym-goers in Saudi Arabia have built meaningful connections whilst working out. The United Arab Emirates tells a similar story, albeit slightly lower, with 18% forming several close relationships and 22% forming a few—still making up nearly 40% of respondents. These numbers closely align with a recent report from the UK, which. states that 42% of people have found meaningful connections at the gym (The Gym Group, 2024).

For others, the gym remains more of a place for passing fist bumps and friendly waves. Roughly 29% in Saudi Arabia and 33% in the United Arab Emirates say they only have casual acquaintances, whilst 26% and 28% respectively haven’t formed any new friendships at all. This diversity underscores the multifaceted role gyms play: a bustling social hub for some and a purely fitness-focused environment for others.

Have you formed any meaningful friendships or relationships

as a result of going to the gym?

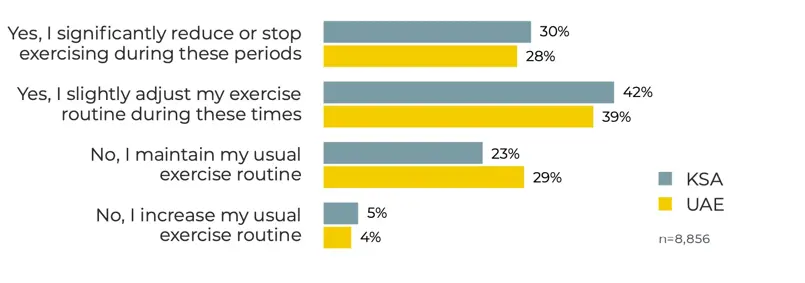

LIFE EVENTS, RELIGIOUS HOLIDAYS, AND THE GYM

Cultural and religious periods can significantly influence schedules, and exercise routines are often among the first habits to be adjusted. When asked how periods like Ramadan or Christmas affect their gym visits, a notable 30% of people in Saudi Arabia say they “significantly reduce or stop exercising,” compared to 28% in the United Arab Emirates . However, these breaks aren’t universal—42% in Saudi Arabia and 39% in the United Arab Emirates only “slightly adjust” their routines, whilst about a quarter (23% in Saudi Arabia and 29% in the United Arab Emirates) manage to keep their habits consistent. Interestingly, a small but dedicated 5% in Saudi Arabia and 4% in the United Arab Emirates actually increase their workouts during these times—often citing more flexible schedules and a desire to maintain (or accelerate) progress.

All of this suggests that social environments, cultural events, and personal beliefs can profoundly shape how people experience the gym. Whether it’s forging friendships on the squat rack or working around religious festivities, fitness in the region is undoubtedly influenced by community and cultural life.

Do life events or religious holidays (e.g., Ramadan, Christmas)

affect your exercise habits?

THE GYM IS A PLACE TO CONNECT SOCIALLY: NEARLY HALF OF GYM-GOERS IN SAUDI ARABIA AND UNITED ARAB EMIRATES HAVE BUILT MEANINGFUL CONNECTIONS WHILST WORKING OUT.

Trends, Tech & The Future

Trends, technology, and a look at what’s next

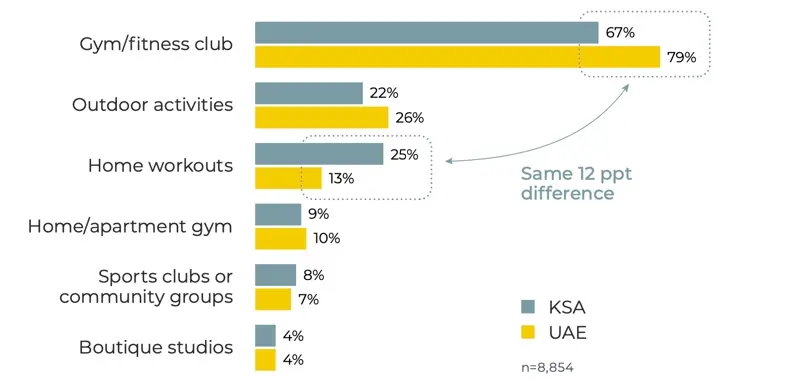

WHERE DO PEOPLE EXERCISE?

Before exploring the latest fitness trends, let’s address a fundamental question: Where do people actually work out? Unsurprisingly, gyms remain the leading choice, but our data reveals intriguing differences between Saudi Arabia and the United Arab Emirates:

The United Arab Emirates shows a higher preference for gym memberships (by about 12 percentage points), underscoring the country’s already robust fitness infrastructure.

Saudi Arabia, on the other hand, shows a parallel 12 percentage points lean towards home workouts, likely shaped by factors such as gym accessibility, pricing, and cultural norms.

Where people exercise

This insight reinforces GymNation’s decision to further expand across Saudi Arabia, with the aim of converting more at-home exercisers into gym-goers by providing budget-friendly, high-quality facilities. After all, we believe factors such as gym availability and pricing could play a significant role in this shift.

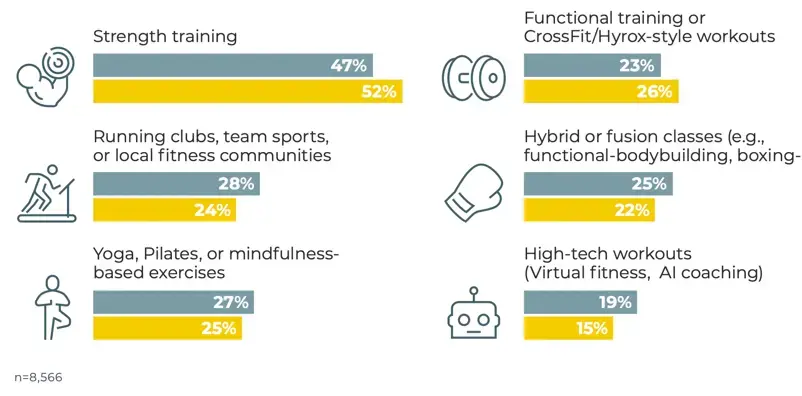

Which exercise trends interest you?

WHICH TRENDS ARE CATCHING PEOPLE’S EYES?

Building on the “where,” we also asked people about the “what”—specifically, which trends peak their interest for the coming year:

- Strength training claimed the top spot, with nearly half of respondents in Saudi Arabia (47%) and just over half in the United Arab Emirates (52%) planning to try it within the next year. This is a promising sign of growing awareness about the numerous benefits associated with strength training.

- Functional training (CrossFit, Hyrox-style workouts) appeals to roughly a quarter in both markets (23% in KSA, 26% in the UAE).

- Yoga, Pilates, or mindfulness-based exercises garnered interest from 27% in KSA and 25% in the UAE, highlighting continued enthusiasm for holistic well-being.

- Running clubs, team sports, or local fitness communities drew 28% in KSA and 24% in the UAE—ideal for those craving a sense of outdoor camaraderie in their fitness routine.

- Hybrid or fusion classes (functional-bodybuilding, boxing-HIIT, etc.) captured the imagination of around a quarter, with slightly more in KSA (25%) than the UAE (22%).

- High-tech workouts (AI-driven coaching, virtual fitness) are on the radar for 19% of KSA and 15% of the UAE, signalling a steady interest in digital solutions.

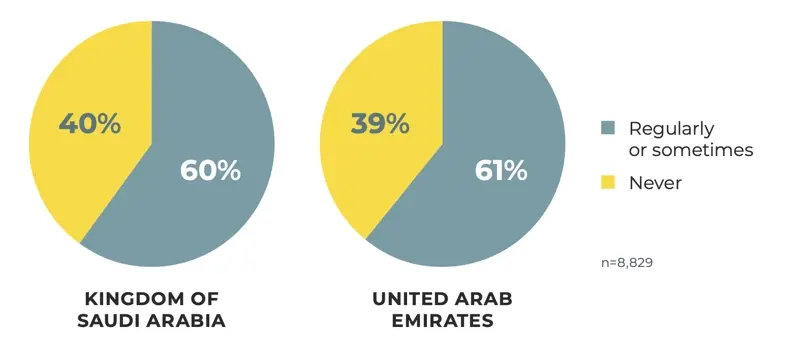

EMBRACING TECHNOLOGY

Wearable devices, such as Apple Watches, Whoops, Garmins, and Fitbits, are transforming the way users monitor their fitness journeys by providing real-time data to track progress and refine workouts. Our data highlights a strong demand for these tools:

- 60% in Saudi Arabia and 61% in the United Arab Emirates report using wearables regularly or sometimes, leveraging features like heart rate monitoring, step tracking, and calorie counting to stay accountable and optimise their fitness routines. However, despite the growing popularity of digital tracking, there remains a significant portion of the population who are not embracing this tech:

- 40% in Saudi Arabia and 39% in the United Arab Emirates state they never use wearables. This indicates that while wearables have become a dominant trend, many still favour simpler or more conventional approaches to tracking or don’t track at all.

How often do you use wearable technology?

60% IN SAUDI ARABIA AND 61% IN THE UNITED ARAB EMIRATES REPORT USING WEARABLES, LEVERAGING FEATURES LIKE HEART RATE MONITORING, STEP TRACKING, AND CALORIE COUNTING TO STAY ACCOUNTABLE AND OPTIMISE THEIR FITNESS ROUTINES.

LOOKING AHEAD—WHAT WOULD ENCOURAGE MORE EXERCISE?

Market Research: A Global Comparison

A global view of market dynamics and an outlook on the region’s future

THE MIDDLE EASTERN FITNESS MARKET IS BOOMING, AND HERE’S WHAT WE EXPECT TO UNFOLD OVER THE COMING YEARS

Fitness penetration rates in the Middle East, particularly in the UAE and KSA, are currently experiencing the fastest growth in the world. Saudi Arabia recorded a 16.8% CAGR from 2020 to 2023, while the United Arab Emirates ranked third with a CAGR of 5.8%. This suggests that the UAE market is becoming more mature compared to KSA. However, the UAE remains significantly large in a global context. To put this into perspective, the UAE achieved a growth rate that was 11 times higher than the UK’s penetration rate during the same period (IHRSA, 2020; Health & Fitness Association, 2024).

SO, WHAT DOES THE FUTURE HOLD?

The Middle East market is in the early growth phase of the low-cost fitness segment, similar to what the United Kingdom experienced in 2011 when this market began to gain traction. The UK saw exponential growth over the next eight years until COVID-19, with low-cost gym members growing at a CAGR of 39%. In contrast, the traditional private gym market experienced zero growth, with membership numbers regressing from 4.3 to 4.2 million during the same period (The Gym Group PLC, 2016, 2020).

Interestingly, our theory is supported by individual research from the Ministry of Investment and the Ministry of Sport (2023), which provides a five-year forecast indicating low-cost male membership growth at 35–40% CAGR and low-cost female membership growth at 40–45% CAGR.

Most expensive cities in the world for gym memberships:

LOW-COST OPTIONS AND ACCESSIBILITY ARE KEY TO UNLOCKING GROWTH IN THE FITNESS INDUSTRY.

We believe we are in the early stages of a low-cost, high-value revolution in the region, making fitness accessible for millions in the years to come. Research conducted by Deutsche Bank (2019) revealed that Dubai ranked as the third most expensive city globally for gym memberships, with Riyadh in fifth place. Compared to Stockholm, which is recognised for having the highest gym membership penetration rate globally, Dubai’s gym fees are 150% higher. Additionally, they are 25% more than London and 15% more than New York City.

Additionally, independent research from the Health & Fitness Association (2024) indicated that 25% of young Saudi women reported a lack of nearby facilities as the main barrier to physical activity. This finding, combined with our large-scale survey showing that availability and price are significant limiting factors to the growth and accessibility of fitness in the Middle East, underscores the need for more affordable gym options and an increase in fitness centres that cater to the region’s young population.

As low-cost gyms continue to rise, they will likely disrupt the traditional fitness market in this region by providing more inclusive options that cater to diverse demographics. Furthermore, we believe that innovation in technology will play a crucial role in this transformation. We expect the integration of technology and AI to enhance the user experience and boost productivity, ultimately lowering costs and increasing value even further.

In conclusion, the future of the Middle Eastern fitness market looks promising, especially for the low-cost segment. We at GymNation aim to fill this need and commit to contributing to regional growth.

FITNESS PENETRATION RATES IN THE MIDDLE EAST, PARTICULARLY IN THE UAE AND KSA, ARE CURRENTLY EXPERIENCING THE FASTEST GROWTH IN THE WORLD.

Wrapping It Up: Conclusion

Final thoughts

This research set out to explore how people in Saudi Arabia and the United Arab Emirates perceive and pursue health and fitness. Both countries share a strong, rapidly growing demand for fitness, making health and fitness a primary aspiration. This has led to unprecedented growth in these industries, yet each market reveals unique nuances.

Saudi Arabia

Saudi Arabia’s fitness market is expanding at an extraordinary rate, evidenced by the fact that half of the gym-goers in the survey identified themselves as newcomers. The industry has flourished since the first licensed women’s gym opened in 2018, with ongoing demand for more gyms and flexible membership options. This growth trajectory aligns with recent data showing a penetration rate growing at 16.8% CAGR from 2020 to 2023—one of the fastest in the world.

Affordability remains crucial, given that large segments of the population feel constrained by cost. Research also highlights that 62% of respondents plan to increase their health and fitness spending in 2025, compared to only 24% in the UK.

However, accessibility is also a concern. According to independent research from the Health & Fitness Association (2024), 25% of young Saudi women report a lack of nearby facilities as the main barrier to physical activity. Additionally, Saudi Arabia ranks amongst the world’s most expensive cities for gym memberships, with Riyadh coming in fifth. The combination of pricing constraints and limited facilities underscores the need for more low-cost gyms that can cater to the region’s growing and increasingly diverse fitness population.

United Arab Emirates

As a more established fitness market, the UAE still boasts high numbers of newcomers but shows a slightly higher uptake in gym memberships compared to Saudi Arabia. Like KSA, the UAE also prioritizes affordability, with 55% of surveyed individuals intending to increase their fitness spending in 2025.

The UAE’s market maturity is reflected in its penetration rate growing at 5.8% CAGR—ranking it third globally—but it remains significantly large in a global context; during the same 2020–2024 period, it experienced growth at about 11 times the rate of the UK.

Despite this relative maturity, gym costs in the UAE remain high. Dubai, in particular, was cited as the third most expensive city worldwide for gym memberships, making it 2.5 times the price of Stockholm, known for having the highest gym penetration globally. As with Saudi Arabia, there is clearly space to accommodate more budget-friendly fitness options that can fuel ongoing market growth and capture untapped segments.

COMPARING TRENDS WITH THE UK

The UK, a mature European-style market, faces different challenges in terms of fitness engagement. PureGym data shows that 65% of Britons feel they are not taking care of their health as much as they should—double the rate found in our Middle Eastern region—while only 76% cite health improvement as a major aspiration (compared to 92% in KSA and the UAE). Though the UK market is large, it is not experiencing the same explosive growth rates observed in the Middle East.

GROWING THE MARKET, NOT JUST TAKING SHARE

One of the most compelling findings is that 56% of current GymNation members were not gym-goers in the previous 12 months. This indicates that new budget- friendly operators, such as us at GymNation, are expanding the overall fitness market rather than merely drawing members from existing providers. This trend is supported by broader research suggesting that half of both KSA and UAE populations cite cost as a significant obstacle to gym membership.

THE LOW-COST REVOLUTION AND FUTURE OUTLOOK

Recent data suggest the Middle East is at the early growth stage of the low- cost, high-value fitness segment, similar to the UK’s experience in 2011. In Britain, low-cost gyms grew at an impressive 39% CAGR over eight years, while the traditional private gym segment stagnated. In the Middle East, forecasts from the Ministry of Investment and the Ministry of Sport (2023) predict 35–40% CAGR in low-cost male memberships and 40–45% in female memberships over the next five years in KSA.

LOW-COST OPTIONS AND ACCESSIBILITY AS GROWTH DRIVERS

We believe we are witnessing the beginning of a fitness revolution in the region, driven by high-value, low-cost gyms that can open the market to millions of new members. By lowering membership fees, reducing intimidation factors, and expanding locations into underserved areas, operators can significantly boost participation rates—especially amongst populations that previously found gyms too costly or difficult to reach. Moreover, technology and AI are poised to streamline operations and enhance user experiences, pushing costs down even further.

ADDRESSING GYM INTIMIDATION

Despite the demand for fitness, many potential gym-goers are held back by “gymtimidation.” Approximately 50% of females and 42% of males in KSA and the UAE say they feel intimidated by the gym; 72% of females and 50% of males mention not knowing how to use equipment. There are also widespread uncertainties about the correct exercises to perform. These data underscore a crucial opportunity to create supportive environments that alleviate these concerns—especially among first-time gym users.

KEY TAKEAWAYS

- Technology and Mental Health: Technology adoption has soared, with 60% of people using wearables. Mental health is now seen as paramount, with 92% acknowledging its importance.

- High Activity Levels: Around 79% of respondents report exercising at least twice a week, and nutrition also fares well, as 69% maintain healthy eating habits.

- Social Aspect: Nearly half view the gym as integral to their social lives.

- GymNation’s Role: We aim to be the region’s “movement partner,” making healthier living affordable and accessible to everyone. From reducing “gymintimidation” to offering culturally considerate services, we strive to empower individuals to become part of a welcoming, supportive community.

CONCLUSION

The future for KSA and the UAE looks incredibly promising, thanks to government-led initiatives such as Vision 2030 in Saudi Arabia and the Dubai Fitness Challenge in the United Arab Emirates. Strong consumer demand, along with a growing awareness of health and fitness, indicates that the region will continue to experience significant growth in the fitness sector, particularly in the low-cost segment. By addressing issues of affordability, accessibility, and gym intimidation, the industry can tap into a vast, previously unexplored market and contribute to transforming the region into healthier and fitter nations.

References

-

Deutsche Bank Research (2019), Mapping the World’s Prices 2019: Deutsche Bank Cross-Discipline Global Thematic Research.

Available at: https://www.dbresearch.com/PROD/RPS_EN-PROD/PROD0000000000494405/Mapping_the_world%27s_prices_2019.pdf -

DFC (2024), Dubai Fitness Challenge.

Available at: https://www.dubaifitnesschallenge.com/ -

Health & Fitness Association (2024), Global Report: Data and Insights on the Health and Fitness Industry.

Available at: https://healthandfitness.org/ -

IHRSA (2020), Global Report: The State of the Health Club Industry. Supplement to Club Business International.

Available at: https://www.ihrsa.org/ -

Life Time (2024), 2025 Wellness Survey: Sauna Tops Recovery Practices People Want to Try; Building Muscle Remains Top New Year’s Fitness Goal in Annual Life Time Poll.

Available at: https://ir.lifetime.life/news-events/press-releases/detail/1112/2025-wellness-survey-sauna-tops-recovery-practices-people-want-to-try-building-muscle-remains-top-new-years-fitness-goal-in-annual-life-time-poll -

Ministry of Investment and Ministry of Sport (2023), KSA Sports Investment Opportunity: Gyms. Investment Brochure.

-

PureGym (2023), The UK Fitness Report – 2023/24 Gym Statistics.

Available at: https://www.puregym.com/blog/uk-fitness-report-gym-statistics-2023-2024/ -

PureGym (2024), The UK Fitness Report – 2024/25 Gym Statistics.

Available at: https://www.puregym.com/blog/uk-fitness-report-gym-statistics/ -

PwC Strategy& (2024), UK Low-Cost Gyms: Increased headroom for low-cost gyms in the UK.

Available at: https://www.pwc.co.uk/hospitality-leisure/assets/pwc-low-cost-gyms-report.pdf -

Terry, L. (2022), Research reveals the impact of gymtimidation on market growth.

Available at: https://www.leisureopportunities.co.uk/news/Research-reveals-the-impact-of-gymtimidation-on-market-growth/350146/ -

The Gym Group (2024), Fitness and friendship combine for Gen Z as more than a third view working out as a way to socialize.

Available at: https://www.tggplc.com/news-and-media/press-releases/fitness-and-friendship-combine-for-gen-z-as-more-than-a-third-view-working-out-as-a-way-to-socialise/ -

The Gym Group PLC (2016), Annual Report and Accounts 2015.

-

The Gym Group PLC (2020), The Gym Group Annual Report and Accounts 2019.

-

U.ae (2023), National Nutrition Strategy 2030.

Available at: https://u.ae/en/about-the-uae/strategies-initiatives-and-awards/strategies-plans-and-visions/health/national-nutrition-strategy-2030 -

Vision 2030 (2024), Saudi Vision 2030.

Available at: https://www.vision2030.gov.sa/